QuickBooks Online Payroll (QBO Payroll) continues to evolve to address the needs of accounting professionals and small business owners. The 2025 updates introduce new features designed to streamline payroll management, enhance accuracy, and provide more flexibility. However, as with any new tools, there are important limitations and responsibilities to keep in mind.

Below, we outline the key updates, their practical benefits, and essential cautions for users. For those looking to deepen their payroll expertise, we recommend our Payroll Fundamentals course for a solid foundation, Choosing the Right Payroll Service for decision guidance, and All Three Payroll Services in QBO Payroll for a comprehensive look at QBO’s payroll solutions.

Correcting Paychecks for Closed Quarters

What’s new:

QBO Payroll now allows users to edit, void, and record paychecks for quarters that have already closed. This new level of flexibility may reduce the need for manual workarounds or contacting customer support when errors are discovered after quarter-end.

Benefits:

- Users can correct payroll errors more efficiently.

- Adjustments are automatically synced to the Chart of Accounts.

For Premium and Elite Users:

Clients on these plans may request payroll tax amendments directly through QuickBooks. Intuit will work with tax agencies to process necessary adjustments.

- There are limitations to these corrections. Not all errors may be eligible for adjustment.

- Customers remain responsible for any penalties or interest due to late tax payments, unless covered by the Tax Penalty Protection program.

- It is important to review all corrections carefully before submitting, as mistakes can have financial and compliance consequences.

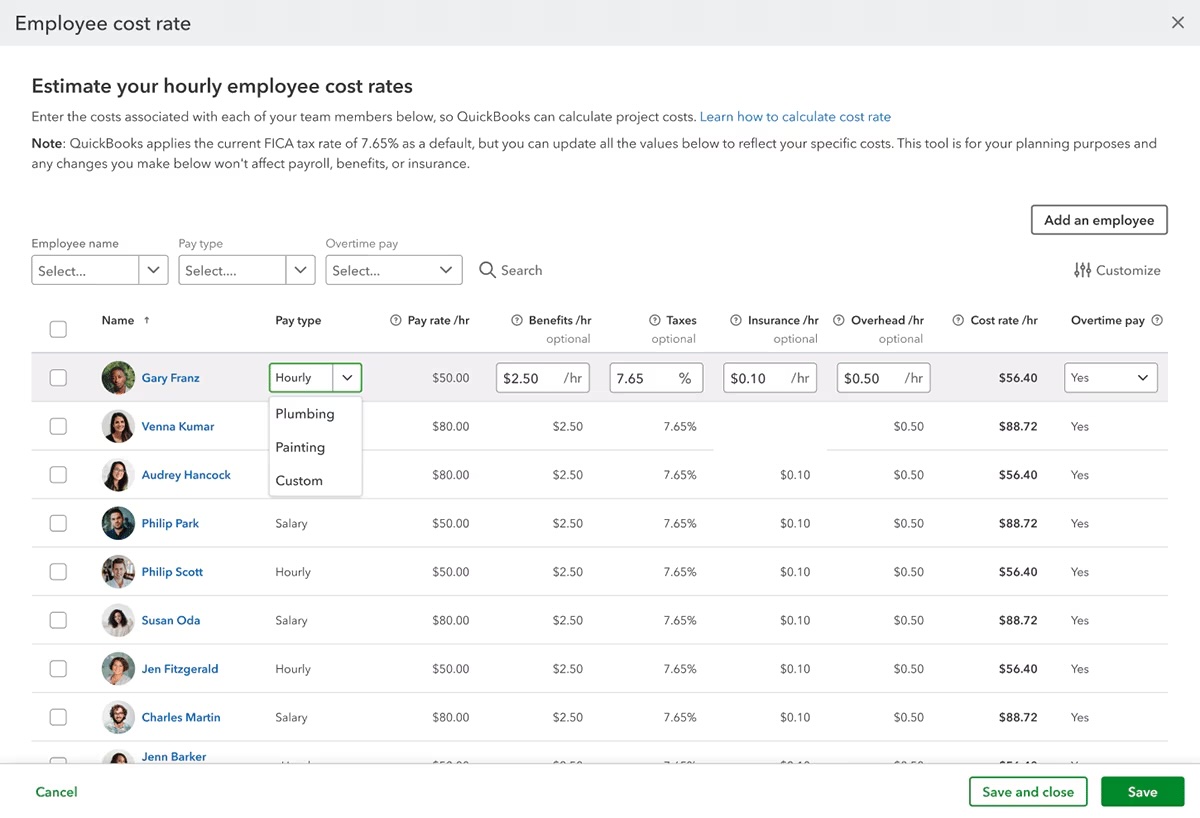

Employee Cost Rate Calculator

A built-in cost rate calculator is now available for QuickBooks Online Plus and Advanced users. This tool enables calculation of employee cost rates, including pay, benefits, taxes, insurance, and overhead, directly within QBO.

- Provides a more accurate, real-time view of project profitability.

- Reduces reliance on external spreadsheets or manual calculations.

- For QBO Payroll users, relevant pay types and rates are automatically populated.

- Cost rates can be updated for multiple employees at once, reflecting organization-wide changes.

- The calculator does not currently account for overtime cost rates.

- Default tax rates, such as FICA, may not reflect all situations. Users should validate all calculations for accuracy.

- As with any automated tool, results should be reviewed before relying on them for financial decisions.

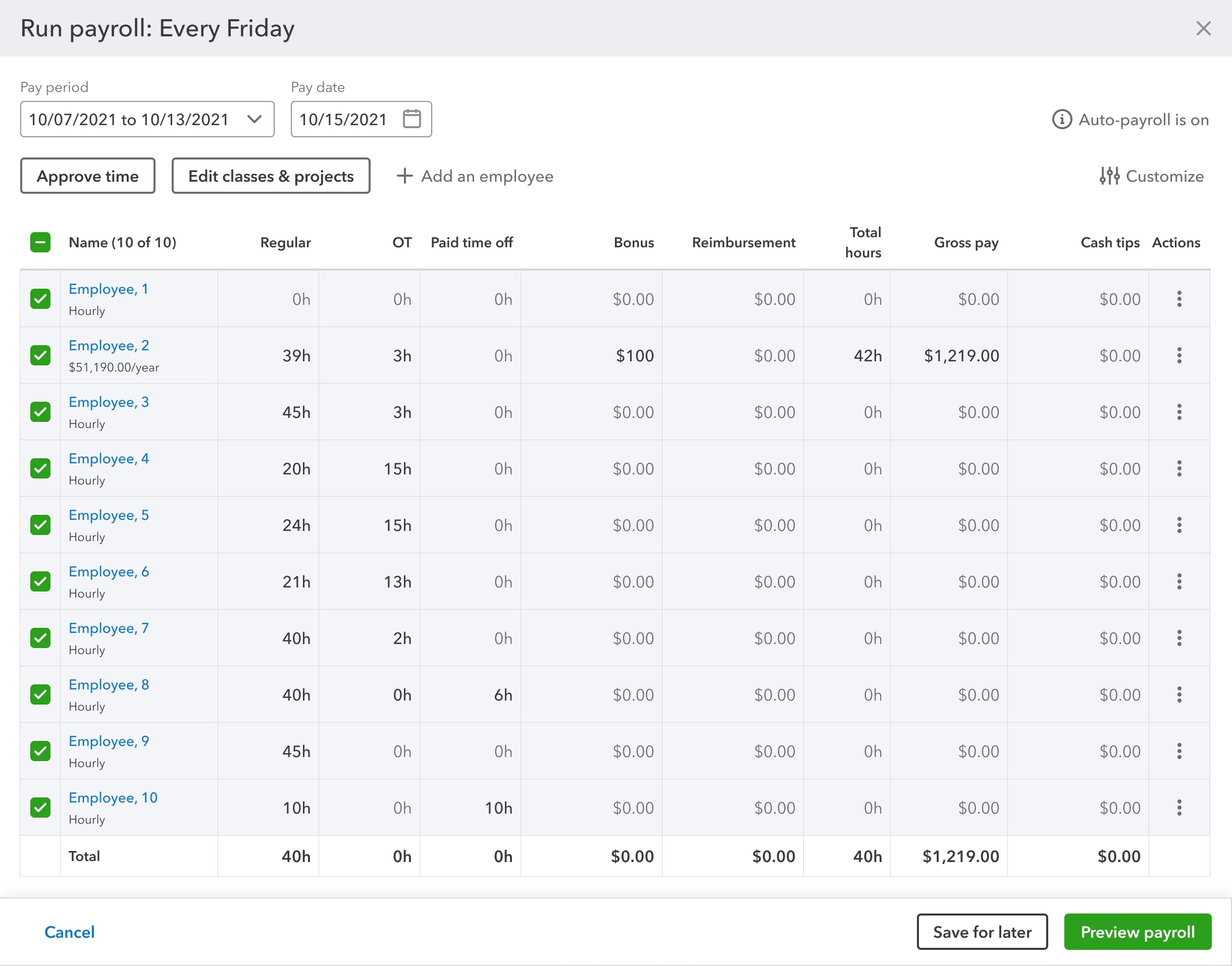

Enhanced Payroll Cost Allocation

QBO Plus and Advanced, in combination with Payroll Premium or Elite and QuickBooks Time, now allow for detailed allocation of payroll costs by customer, project, or class. Users can split wages across multiple categories within a pay period, and payroll taxes and contributions are distributed accordingly.

- Supports more granular profit and loss reporting.

- Facilitates identification of labor cost drivers.

- Hours tracked by class, project, or customer in QuickBooks Time flow directly into payroll processing.

- These features are only available with certain plan combinations.

- Accurate setup and data entry are required to ensure correct allocation.

- Users should routinely verify that allocations match business records and reporting needs.

Introducing the Payroll Agent: Automated, Proactive Payroll Management

A major enhancement in 2025 is the introduction of the Payroll Agent, an AI-powered feature designed to proactively manage payroll tasks within QuickBooks Online. The Payroll Agent can automate payroll runs, collect and process payroll data, and request confirmation or approval from payroll managers when needed.

- Reduces manual intervention by automating routine payroll processes.

- Helps ensure payroll is processed on time and in compliance with company policy.

- Provides notifications for tasks that require attention, helping to minimize errors and missed deadlines.

- Automation is not a substitute for human oversight. Payroll managers should continue to review payroll runs and confirmations for accuracy.

- The Payroll Agent’s recommendations and actions should be validated, especially when new or complex scenarios arise.

For a deeper dive into the Payroll Agent’s capabilities and practical considerations, see these resources:

- New Agentic AI Payroll Agent for QuickBooks Online – Insightful Accountant

- AI Agents in QuickBooks Online – School of Bookkeeping

Additional Payroll Learning Resources

- Payroll Fundamentals: Build a solid understanding of payroll basics and compliance.

- Choosing the Right Payroll Service: Get expert guidance on evaluating and selecting the best payroll provider for your needs.

- All Three Payroll Services in QBO Payroll: Compare Core, Premium, and Elite payroll options and features in detail.

Important Product and Compliance Notes

- Money movement services are provided by Intuit Payments Inc. See full license information here.

- Time tracking and certain payroll features require QBO Payroll Premium or Elite.

- Tax rates and calculations are estimates and should always be validated before filing with the IRS.

- Customers are responsible for ensuring compliance with all payroll and tax regulations.

Conclusion

The 2025 updates to QuickBooks Online Payroll offer expanded functionality and greater flexibility for correcting payroll errors, calculating employee costs, allocating payroll expenses, and now, automating payroll processes with the Payroll Agent. While these enhancements can improve efficiency and accuracy, users should remain attentive to the limitations and responsibilities associated with each feature. Careful review and validation are essential to avoid compliance issues and unexpected penalties.

If you have questions about these updates or need guidance on best practices for payroll management, the School of Bookkeeping is here to help. Contact us for support tailored to your business needs.

If you would like to learn more tips and tricks, click here to access our entire course library!!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.