If you have been using QuickBooks Online for a while, you probably know your way around the old bank feed. It was not perfect, but at least you knew what to expect. When Intuit announced a new bank feed with AI features, you might have rolled your eyes and wondered why they had to change something that was working just fine.

What are the differences with the old bank feed?

| Old Bank Feed | New AI-Powered Bank Feed | What's Different? |

|---|---|---|

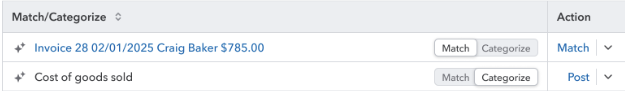

| Match QuickBooks suggests transactions that look identical to entries in your books. |

Match (AI-Powered) AI suggests matches with higher accuracy and provides a switch to toggle between Match and Categorize. |

AI learns your preferences and improves suggestions over time. The switch makes changing between Match and Categorize easier. |

| Categorize You manually choose an account or category for each transaction. |

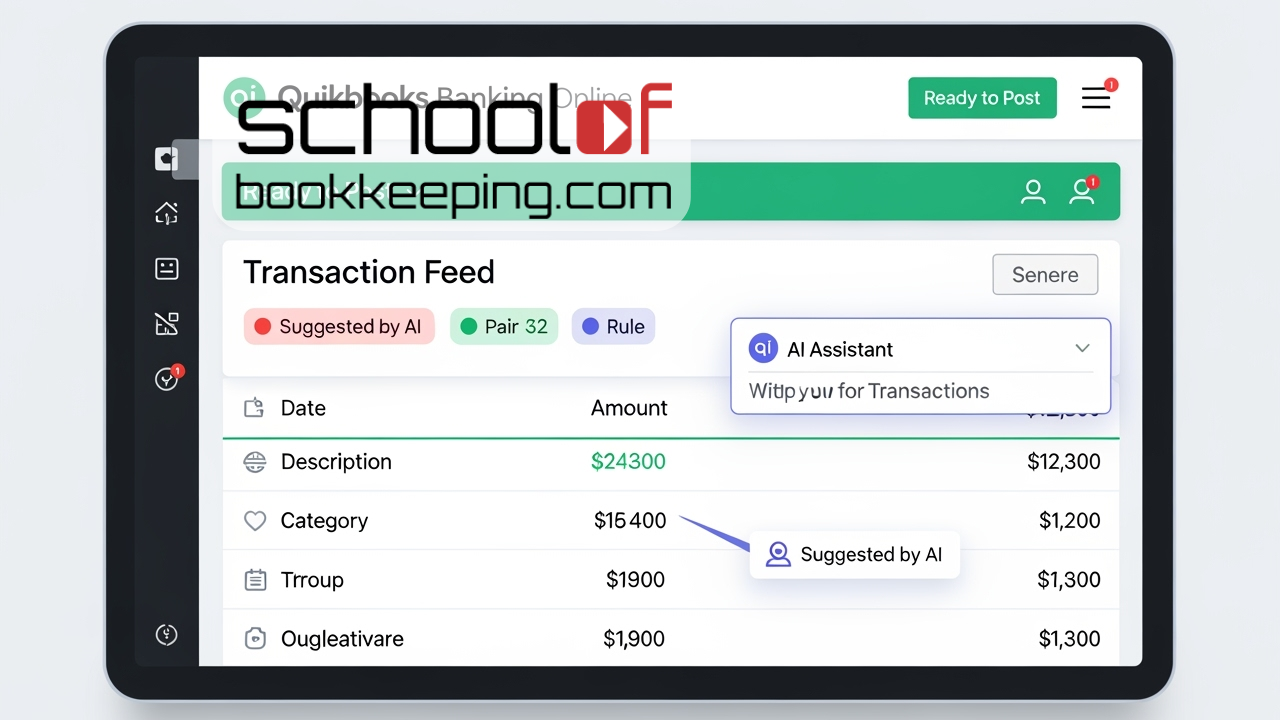

Categorize (with Suggestions) AI suggests categories based on your history and other businesses. |

Suggestions are more personalized and visible. You see a "Suggested by AI" icon for confidence picks. |

| Rules User-created rules auto-categorize transactions. |

Rule Badge Rules still apply, but now show a badge when used. |

Rules are more clearly marked, so you know when they’re applied over AI suggestions. |

| Split Option to split a transaction into multiple categories (not always obvious). |

Split (Dropdown) Split and categorize history options are now in an easy-to-find dropdown. |

Splitting is more accessible and visible in the Action column. |

| For Review / Reviewed Transactions are either pending (For Review) or posted (Reviewed). |

Pending / Posted Pending transactions await your action; Posted transactions are in your books. |

Terminology is updated for clarity, but the workflow is similar. |

| Transfers & Card Payments Manual identification, risk of duplicates. |

Pair Badge AI flags transfers and credit card payments with a Pair badge. |

Reduces duplicates and makes these transactions easier to spot. |

| Customization Limited ability to add or remove columns or resize the table. |

Customizable Table Add, remove, or resize columns; inline editing is available. |

More control over what you see and how you work. |

| Manual Collaboration Requests for info handled outside QuickBooks (email, calls). |

Requests for More Information Request info or documents directly from the transaction. |

Streamlines collaboration with accountants or clients. |

| No Batch Posting Each transaction handled one at a time. |

Ready to Post Batch review and post high-confidence transactions at once. |

Saves time by grouping transactions for faster posting. |

| Basic Suggestions QuickBooks sometimes guessed, but not always well. |

Suggested by AI Icon See when QuickBooks has high-confidence suggestions and why. |

More transparency and control over suggestions. |

| Limited History Past categorizations not always easy to find. |

Categorization History View how you categorized similar transactions for a vendor or customer. |

Helps keep your records consistent and reduces guesswork. |

Less Manual Work

Customization

Smarter Suggestions

Fewer Duplicates

Rules Still Work

Batch Processing and Collaboration

Clearer Status

Why Make These Changes?

- Save time by cutting down on repetitive tasks

- Reduce mistakes by making smarter suggestions and preventing duplicates

- Customize your workspace so you see what matters most to you

- Get better at categorizing transactions as the system learns from your choices

- Make it easier to work with accountants or clients by asking for info right from the transaction

Helping Make it Better

Because Bank Feeds is such a central part of accounting professional toolbox, Intuit's is piloting a new way to provide feedback for this bank feed experience. You can now see other user's feedback, vote on it to raise awareness. The best part is that the Product team atIntuit can communicate updates back to you, and you can see what has been implemented and feedback they are working on. You can set up a login to Canny here. https://intuit.me/bankfeeds_FB

Final Thoughts

If you would like to learn more tips and tricks, click here to access our entire course library!!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.